Zimbabwe Stock Exchange To BE Dollarised

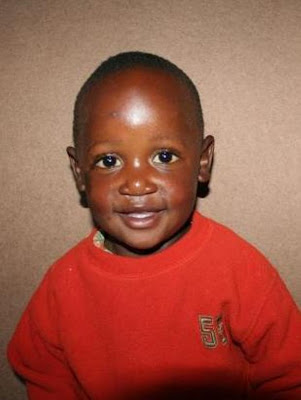

Please do take a moment to sign our petition to free 2 year old Nigel from Maximum Security Prison in Zimbabwe, where he is being kept in solitary confinement together with his mother. To read his tory and sign the petition, please click here

In a move that betrays the imminence of the complete dollarisation of the Zimbabwean economy, sources at the Reserve Bank of Zimbabwe now indicate that the Zimbabwe Stock Exchange will almost certainly be dollarised by March of this year.

A study was apparently commissioned by the RBZ Governor, Gideon Gono in December last year just as he cracked down on the Stock Exchange. It was also the period when he virtually went the route of wholesale licencing of shops and service providers to charge in foreign currency.

The study, which is apparently still a secret document, argues that the Stock Market has been traditionally one of the drivers behind Zimbabwe's hyperinflation. According to sources at the Central Bank, the paper also presents "a compelling case" that as long as trading on the local bourse is in local currency, there will always be abitrage opportunities which "will invaribaly attract speculators and not investors to the Zimbabwe Stock Exchange."

I must say I was floored to hear this. It was the last thing I expected but apparently it is set to happen during this quarter. Gono himself has apparently been won over by the argument and has presented it to Mugabe. Sources at the Central Bank say the Governor has claimed that the president sees that there is no other way to plug the Zimbabwe Stock Exchange inflationary hole in the economy except allowing the bourse to trade in foreign currency.

The modalities of the proposed move are that payments will be made into foreign currency denominated accounts upon the completion of a sale on the ZSE. What this means is that, effectively, only those with foreign currency accounts will be able to immediately take advantage of this move.

The rest may have to wait. I just spoke to my bank a few minutes ago to hear of the requirements if you do not already have an FCA. It appears that to open one, you should have a minimum balance of US$500 (if the account is to be denominated in US dollars). My manager says you will also be able to open a Foreign Currency account if you can demonstrate that "you are expecting money equal to or in excess of, the minimum required balance."

This move is the strongest indication yet that the news I gave you a few days ago that Zimbabwe had approached South Africa to be allowed to use the Rand officially is now closer to being realised and hence made public.

As you know from that story I published on this blog, Tito Mboweni and the South Africans put the ball back in Zimbabwe's court by demanding that inflation be first tamed in Zimbabwe, hence the moves we are now witnessing of gradually dollarising the Zimbabwean economy.

The South Africans had also asked the Zimbabweans to put together a proposal on how they would deal with the South African demand for monetary policy to be taken out of the hands of the RBZ in the event of a monetary union being implemented. My sources are now saying that the RBZ is proposing a solution similar to the Namibian Central Bank's relationship with the South African Reserve Bank. I am not well-versed on this particular point but I will do some research and tell you how the two relate to each other. What we do know is that the Namibians use both the Rand and Namibian dollar in day to day trading, with the Namdollar being treated as being on par with the Rand.

There had also ben talk that the South Africans required security of some sort, in essence, the same principle as that which underpins paper money (where the paper money has to be backed by something of equal value, normally gold reserves, in the vaults of the issuing authority). The Zimbabweans were said at the time to be thinking of putting up our vast platinum reserves (the second largest in the world after South Africa) as collateral for the South Africans.

You will recall that a few days after I broke that story, the government newspaper, The Herald, started preparing the country for this move by publishing a series of articles looking at the "pros and cons" of official dollarisation.

The paper has also announced that the government is looking into paying civil servants in foreign currency.

Previous Articles: (Please click on one to read the full post)

Comments

Post a Comment

Comments from Anonymous Users will NOT be published